Three Questions for Bill Richardson Part 4

Hello everyone. Hope all is well. Below is the most recent instalment of questions that I have received from clients and other investment advisors over the past couple weeks.

Question 1: As you know, news coverage is still focusing on the Pandemic. We hear that the situation in the US is still pretty bad. What are your thoughts about how this will affect financial markets?

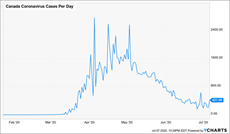

The charts for daily cases of Coronavirus for the US and Canada look quite different:

In Canada, we have made better progress and now regulations regarding wearing masks are getting even tighter whereas the US is acting more like it is an election year where they are desperate to get the economy rolling again.

Despite the rising cases in some of the US states, markets have remained quite strong. We have been riding the positive trends and trying to avoid the weaker ones. Markets tend to look three to nine months into the future and have been very strong since the mid-March panic lows. Stocks that we owned prior to the Pandemic were trending strongly and when things turned around they snapped back quickly.

Remember, we buy stocks with strong fundamentals and earnings growth that are trading at reasonable prices. Then, we diversify as they are not all going to work out. When we see a trend change, we change. We are watching the Coronavirus and the trends very closely. Shifts happen and we will be ready to shift when they change.

Question 2: Should Canadian portfolios hold mostly Canadian stocks?

We hear people who invest at other firms complaining all the time that their portfolios are not performing well and then when we take a look at them, we see they are mostly made up of Canadian stocks. As you may already know, Canada makes up less than 3% of the world economy while the US makes up more than 50%.

For those of you who don’t dig deeply into equity research, you may not know that the TSX 60 index that is often referred to by the financial news is made up of 32% financial services, 13.5% Energy and 12.5% Basic Materials (Mining). In other words, over ½ of the Canadian economy is represented by just 3 sectors which is very narrow. Energy and mining stocks tend to move sideways with considerable volatility which is okay for traders but not so great for longer-term investors.

There are many more companies to choose from in the US and far greater diversification outside the volatile energy and resource sectors. Companies like Apple, Amazon, Microsoft, McDonald’s, Home Depot, Mastercard, Visa, Netflix, Starbucks, Facebook, Google, Tesla, etc…many of which we currently own or have owned previously. If we rank companies by size, the 100th biggest company in the US is Activision Blizzard (Video game and console manufacturer) that we own is valued at $61 Billion. In Canada, the 100th biggest company is Lundin Mining, valued at $5.7 Billion (1/10th the size). Royal Bank, the second-largest company behind newcomer Shopify is valued at $130 Billion, which would rank it at around number 45 in the US.

This broader diversification and worldwide corporate leadership have helped the S&P 500 gain 262% over the past 10 years while the TSX Composite index is up just 37% over the same period. Despite the multitude of opportunities outside our country’s border, most Canadians continue to overweight their portfolio in Canadian companies and as a result, have underperformed by a wide margin over the past decade. This trend seems to be continuing as most Canadian balanced mutual funds are still negative YTD and over the past year (YCharts July 2020).

Question 3: What about Real Estate?

Canadian Commercial real estate (Real Estate Investment Trusts) have done well over the past 10 years (7.02% annualized) but 5-year performance has slipped to 3.30% (Source: YCharts July 2020), mostly due to the Coronavirus. It has very much lagged other stocks in the recovery. There are several real estate areas that I would avoid in the short-term. Shopping malls and office buildings are two areas that I would be careful with. Apartment buildings still look okay as rent collections have been strong. Homes in Florida, Arizona or other sunshine states may also hold up well as many companies are allowing their employees to work from home, some indefinitely. This may encourage workers to migrate from higher-cost locations like New York or San Francisco to lower-cost areas with favourable climate.

As always, please let us know if you have any questions or concerns. Feel free to share with family and friends that you think would benefit.

Thanks,

Bill