What’s the Deal With Bonds?

- As a Baby Boomer, have you noticed that you have spent most of your life on the wrong side of interest rates?

- When young, getting married, raising children and purchasing their first homes, interest rates were high for this generation. Most of the early mortgage payments were all interest with hardly a dent made in principal for years.

- Now matured, the tables have turned for Boomers who are retired or in the late stages of a career. Most have eliminated debt and are investing regularly for a nice retirement. Now that you have money to invest, interest rates are low, and it is difficult to generate sufficient low-risk income.

- As a result, many Boomers have turned to equities (stocks), ETFs or mutual funds to generate returns.

- This has created a difficult situation for many new retirees: Interest rates are low and traditional fixed income products like GICs and bonds (The Canada Savings Bonds has actually been cancelled!) can’t generate returns high enough for them to meet your financial planning and wealth management goals. Meanwhile, equity markets can go up and down, often subject to boom and bust cycles and general market volatility. Losing 10 or 20% of your retirement nest egg due to any of these factors could actually delay or dash severely your retirement game plan – at a time when retirees do not have the time or salary to recoup such losses.

- Let’s look at traditional fixed income markets to help you better understand the potential risks and rewards and perhaps some new, alternative ways to generate income!

Here’s a look at the current state of interest rates in Canada and how this may affect your investing or financial planning as a result:

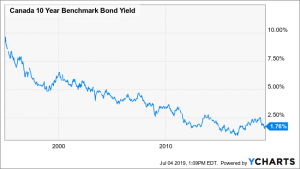

- A traditional approach to investing has long been that a certain portion is invested in federal or provincial government bonds. The chart below shows the yield on Government of Canada 10-year bonds:

- From this chart, you can see that interest rates have dropped from just under 10% to a low of about 1.2% in October 2016. Then they went on a tear and rose to 2.5% in November 2018 and have settled back to 1.71%.

- A question for all investors in bonds: Does your approach to asset management include lending money to a government or financial institution at 1.71% for 10-years and pay fees for somebody to manage that investment? That is precisely what you are doing when you buy a bond mutual fund. While ETFs have a slimmer fee structure, there is not getting around the fact that the returns on these investments has been negligible. After fees and inflation have their impact on return.

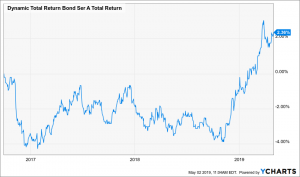

- Let’s look at the investment company Dynamic and their Total Return Bond Fund A Series merely as an example of the many bond funds in Canada: The A-Class has an expense ratio of 1.63%.

- The chart below shows how this mutual fund has performed since September 2016 when rates bottomed. You would have received a total return of 2.36% over 945 days. You would have received a return of 0.9% per year over that period while the managers and advisors made 1.63% per year over that period and with rates having dropped again, prospects for good returns going forward are not good and if rates rise, you may be looking at negative returns.

- Given that inflation usually runs around 1.5% to 2% per year, the bond mutual fund or ETF element of financial planning seems like a losing proposition currently. The real question to be answered is: where do I find more reliable returns on the Fixed Income portion of my portfolio? This is a question we look to answer in this series.

“So, where Are Interest Rates Headed?”

We are not in the business of making predictions so we are not going to offer any opinions on where interest rates will be in a year’s time. It is no different than putting your money up for a football or hockey pool. It is fun to play but we don’t usually do much better than flipping a coin. Nevertheless, historical trends can be helpful in at least explaining where we have been and where we might be headed in the future if certain events occur.

- From 1981 to 2016, rates were in a strong trend so it was a reasonable bet that they would be lower the next year. As this trend matured, the odds were higher that there would be a change in direction, but the trend remained intact for almost 40-years.

- In 2016 rates got close to actual zero and there was discussion that we might see negative interest rates. That is, if you put money in the bank, you would have to pay the bank to hold onto it. That seems far-fetched, but it has occurred during the last 5 to 8 years in Europe and anything is technically possible.

- Governments use interest rates to help them mange the economy. If the economy gets overheated, they will raise interest rates, which increases the cost of money and people or businesses will stop spending as readily as they may have during times of cheaper money.

- A likely scenario is that rates will remain locked in a fairly tight trading range, perhaps between 1% and 3%. Rates may go higher if the Canadian Dollar shows some strength against the US Dollar as our 10-year rates are 1.71% and US 10-year rates are 2.51%. If the Canadian Dollar were to rise against the US Dollar, this spread would tighten and possibly force Canadian rates to rise some.

“What are the Risk Factors with Bonds?”

Although fixed income investments like bonds are generally some of the safest investments available, there are some risks about which investors should be aware.

- When an investor purchases bonds, there is greater flexibility but there are some additional risks. Government bonds are generally regarded as the safest bonds unless you decide to venture outside of Canada into some less developed countries. If you hold government bonds to maturity, your risks are minimal. An investor does have Interest Rate Risk. If rates rise, the price of the bonds decline to adjust the price to the new yield than such an investor would want if he invested today, but if rates decline the investor can sell these bonds at a profit.

- Risk increases when you start investing in corporate bonds or debentures as there is a much longer list of issuers and broader range of bond quality. Royal Bank of Canada has a much higher rating than a western Canadian small cap energy company – and this is where risk comes into play. Investors might compare Bank of Montreal (BMO) bonds to those issued by Canadian Natural Resources (CNQ) and choose CNQ because the yield is higher, but they are taking on much more risk for a small increase in return.

- Another thing for the fixed income investor to be aware of is the complexity of the offering. By way of an example, a few years ago, many corporations offered rate re-set preferred shares. Under the terms, the investors would benefit when the rates were reset, as it was assumed with low rates that they were bound to increase. Unfortunately, rates continued to decline. Investors were locked into lower rates and the value of the shares plunged by 25% to 30%.

- Sometimes, it is worth taking the higher risk for higher returns but make sure that you are taking all conditions into consideration, it may be a good idea to pay a professional manger by investing in a mutual fund to spread and manage the risk but at the same time make the returns are sufficient to the justify fees. And with rates often well below 2.5%, that type of return is difficult to find. Even with no load funds, the Management Expense Ration (MER) may still eat up much of the return.

So, what is an investor to do to find a reasonably stable income stream that complements their equity portfolio? In our next post we will very briefly examine the newly emerging and exciting products from the world of Alternative, Private Market Investments.

“Is There any Alternative Investment?”

A major shift has been taking place at the institutional investment level over the last 20 years or so. Major Pensions like the Canada Pension Plan as well as the largest of endowment funds at universities like Yale and Harvard have moved away from the low interest public investments such as bonds in recent years. Instead, a shift towards using private equity and debt has been occurring.

- Private equity and debt is investing in smaller companies that are privately owned and are not traded on financial exchanges like the Toronto Stock Exchange. Liquidity is often reduced but the rewards can be significantly improved while volatility actually reduced.

- At Harbourfront Wealth Management via Willoughby Asset Management, we launched a new pool just over a year ago, The Rockridge Private Debt and Real Estate Pool. Rockridge uses strategies like factoring, bridge loans and investment in Real Estate and Mortgage Investment Corporations to provide investors with superior returns in a professionally managed and diversified pool.

“I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of Harbourfront Wealth Management. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by Harbourfront Wealth Management Inc.”

Disclaimer – This information transmitted is intended to provide general guidance on matters of interest for the personal use of the reader who accepts full responsibility for its use and is not to be considered a definitive analysis of the law and factual situation of any particular individual or entity. As such, it should not be used as a substitute for consultation with a professional accounting, tax, legal or other professional advisor. Laws and regulations are continually changing, and their application and impact can vary widely based on the specific facts involved and will vary based on the particular situation of an individual or entity. Prior to making any decision or taking any action, you should consult with a professional advisor. The information is provided with the understanding that Harbourfront Wealth Management is not herein engaged in rendering legal, accounting, tax or other professional advice. While we have made every attempt to ensure the information contained in this document is reliable, Harbourfront Wealth Management is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information is provided “as is,” with no guarantee of completeness, accuracy, timeliness or as to the outcome to be obtained from the use of this information, and is without warranty of any kind, express or implied. The opinions expressed herein do not necessarily reflect those of Harbourfront Wealth Management Inc. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are not to be construed as a solicitation or offer to buy or sell any securities mentioned herein. Harbourfront or any of its connected or related parties may act as financial advisor or fiscal agent for certain companies mentioned herein and may receive remuneration for its services. The comments and information pertaining to any investment products (The Portfolios) sponsored by Willoughby Asset Management are not to be construed as a public offering of securities in any jurisdiction of Canada. The offering of units of The Portfolios is made pursuant to the Offering Memorandum or Simplified Prospectus and only to investors in Canadian jurisdictions. Important information about The Portfolios is contained in the Offering Memorandum or Simplified Prospectus available through Willoughby Asset Management. Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with investments in The Portfolios. Investments in The Portfolios are not guaranteed, their values change frequently, and past performance may not be repeated. Historical annual compounded total returns including changes in unit value and reinvestment of all distributions do not take into account sales, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Unit values and investment returns will fluctuate and there is no assurance that The Portfolios can maintain a specific net asset value. Harbourfront Wealth Management Inc. (“Harbourfront”) has relationships with related and /or connected issuers, which may include the securities or funds discussed in this commentary and are disclosed in our Statement of Policies Regarding Related and Connected Issuers. This policy is included in your new client package, on our website, or can be obtained from your investment advisor on request.